How Novartis’s Revenues Trended in 4Q17

Novartis surpassed Wall Street analysts’ estimates for earnings per share (or EPS) with reported EPS of $4.86 as compared to estimates of $4.82 for 2017.

Mar. 13 2018, Updated 5:40 p.m. ET

Novartis’s revenues in 4Q17

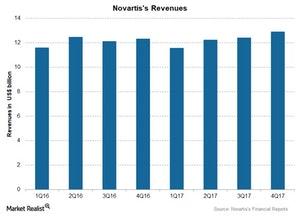

Novartis (NVS) reported 5% growth in revenues to ~$12.9 billion during 4Q17 as compared to ~$12.3 billion during 4Q16. The below chart compares revenues for Novartis since 1Q16.

4Q17 revenues

Novartis surpassed Wall Street analysts’ estimates for earnings per share (or EPS) with posted EPS of $1.21 as compared to the estimates of $1.19 during 4Q17. Novartis also surpassed analysts’ estimates for revenues with reported revenues of ~$12.9 billion as compared to the estimates of ~$12.8 billion during 4Q17. The revenues increased by ~5% including a 2% growth in operating revenues and a 3% favorable impact of foreign exchange during 4Q17.

The US sales reported a 1% decline to ~$4.3 billion during 4Q17 as compared to ~$4.4 billion during 4Q16. European markets saw an 8% increase in sales to ~$4.7 billion during 4Q17, as compared to ~$4.3 billion during 4Q16. The Canada and Latin America markets saw a 7% increase in sales to ~$1.0 billion during 4Q17, as compared to $963 million during 4Q16. The Asia/Africa/Australasia markets saw a ~8% increase in sales to ~$2.9 billion during 4Q17 as compared to ~$2.6 billion during 4Q16.

2017 revenues

Novartis surpassed Wall Street analysts’ estimates for earnings per share (or EPS) with reported EPS of $4.86 as compared to estimates of $4.82 for 2017. However, Novartis missed the revenue estimates for 2017 and reported revenues of ~$49.1 billion as compared to the estimates of ~$49.2 billion during 2017. The revenues increased by ~1% during 2017, including a 2% growth in operating revenues, offset by a ~1% negative impact of foreign exchange.

The US sales reported a 1% decline to ~$16.9 billion during 2017 as compared to ~$17.1 billion during 2016. European markets saw a 2% growth in revenues to ~$17.5 billion during 2017 as compared to ~$17.1 billion during 2016. Sales from Canada and Latin America markets reported 2% growth to ~$4.0 billion during 2017 as compared to $3.9 billion during 2016. The Asia/Africa/Australasia markets reported a ~3% increase in sales to ~$10.7 billion during 2017 as compared to ~$10.4 billion during 2016.

The First Trust Value Line Dividend ETF (FVD) holds 6.3% of its total investments in healthcare companies. FVD holds 0.5% in Novartis (NVS), 0.5% in GlaxoSmithKline (GSK), 0.5% in Merck (MRK), and 0.5% in Bristol-Myers Squibb (BMY).