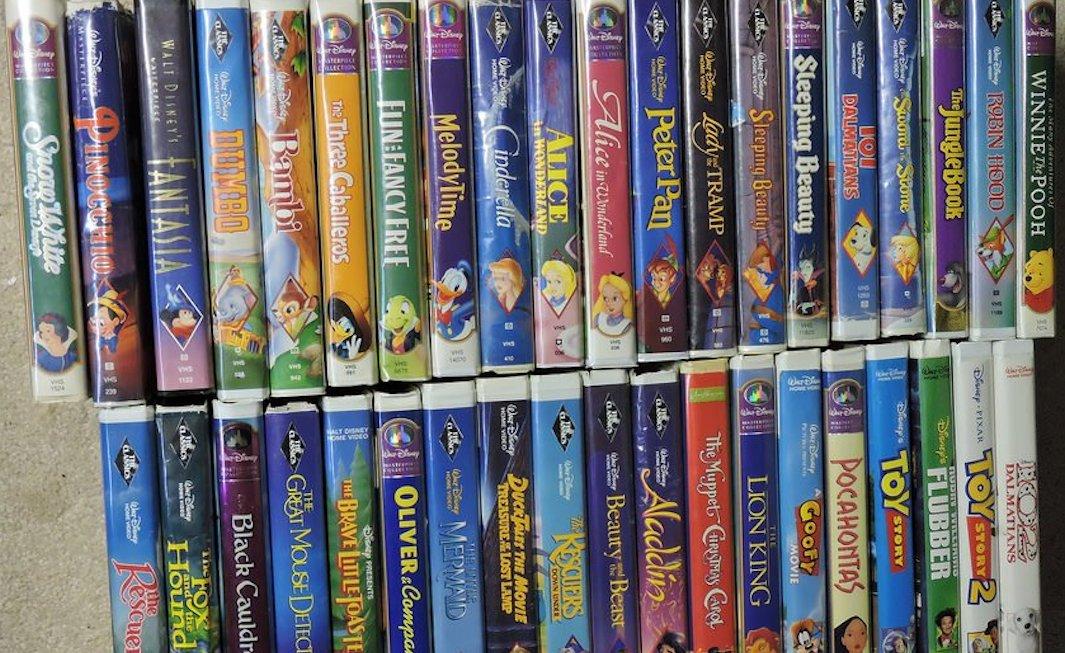

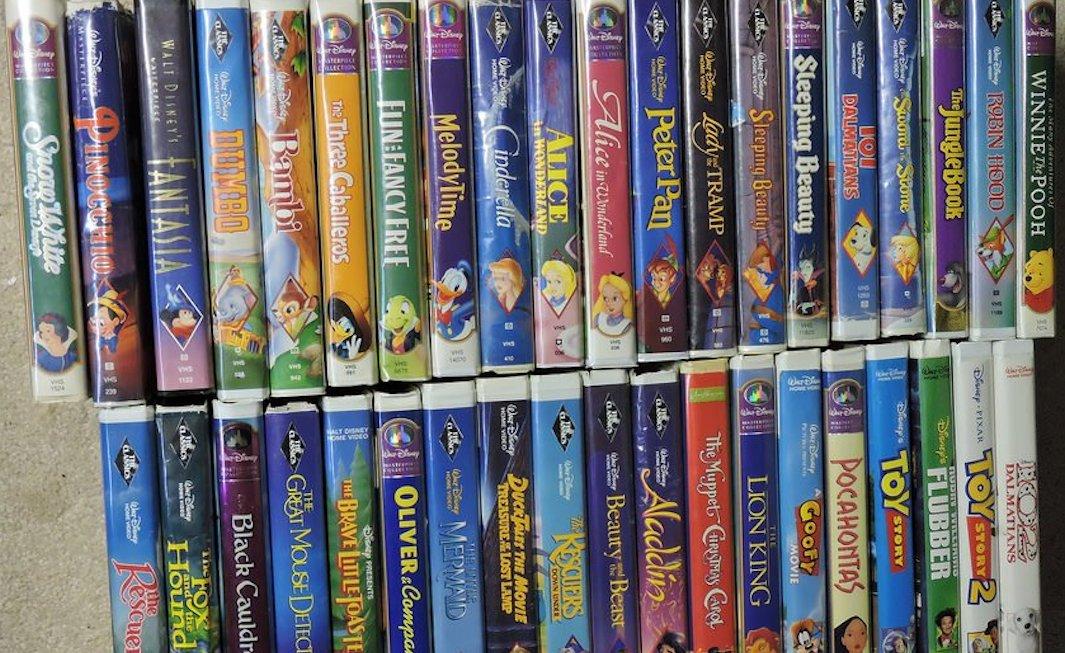

Disney VHS Tapes Can Be Worth Up to $6,000 — Check to See If You Have Any

If you have a box of Disney VHS tapes in around your house, it's time to pull them out because they could be worth thousands — especially certain movies.

Looking for advice on personal finance? From the best credit card rewards programs to the best way to save for retirement, we'll help you get a better rein on your personal finance and tax questions.