Inside Old Dominion Freight Line’s Global Services

Old Dominion unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice.

Jun. 22 2016, Updated 11:07 a.m. ET

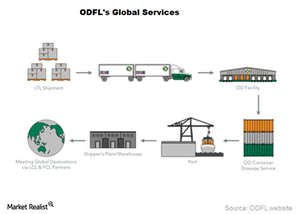

ODFL’s Global Services

In North America, Old Dominion Freight Line (ODFL) offers direct service to Alaska, Hawaii, Canada, Mexico, and Puerto Rico. Out of North America, ODFL renders premium international shipping services throughout the Caribbean, Europe, the Far East, Central America, and South America. The company provides these services through an alliance with Mallory Alexander International Logistics.

Global Assembly and Distribution

The company’s Global Assembly and Distribution (via ocean vessel) business offers assembly for clients to meet worldwide needs. ODFL unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice. The container, when full, is routed to the customer’s designation. Here, Old Dominion provides container drayage service to the port.

In collaboration with WCL (World Confederation of Labor), ODFL also provides OS&D (over, short, and damaged) information, if a client needs distribution at the destination.

Worldwide LCL and Container Load Services

OD Global provides access to Worldwide LCL (less-than-container load) and FCL (full container load) services customized to meet clients’ export and import, foreign-to-foreign, or air freight needs. The company renders these services through its strategic alliance with Mallory Alexander International Logistics. ODFL’s extensive network provides its global shipping clients with the tools needed to make Worldwide LCL & FCL shipping work for their business.

National Container Drayage

ODFL’s National Container Drayage division hauls customers’ FCL import or export or domestic rail shipments from any continental US point of origin to and from ports and rail heads in Atlanta, Baltimore, Charleston, Charlotte (North Carolina), Front Royal (Virginia), Greensboro, Greer, Memphis, Norfolk, Savannah, and Wilmington. The company’s national network also offers seamless service to its cargo and freight shipping clients.

Through ODFL’s Drayage services, export shippers can street-turn and load FCL container boxes for export. Here, the company renders the transport back to the port or rail point of origin service to the export shippers, from their original delivery import destinations.

ODFL is a dominant LTL player in the United States. The other major LTL players competing directly with the company are YRC Worldwide (YRCW), Saia (SAIA), ArcBest (ARCB), J.B. Hunt Transportation Service (JBHT), and C.H. Robinson (CHRW).

Transportation and logistics companies make up part of the industrial sector. Railroads and airlines make up ~5.2% and ~4.8%, respectively, of the portfolio holdings of the iShares US Industrials ETF (IYJ).

Next, we’ll discuss Old Dominion Freight Line’s Technology thrust.