A Look at Evercore’s Business Model

Evercore generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17.

Feb. 15 2018, Updated 7:35 a.m. ET

Differentiated platforms

Evercore (EVR) has expanded its business across its three platforms: Corporate Advisory, Capital Markets Advisory, and Institutional Equities. Its private equity, restructuring, mergers and acquisition, and investment management are the company’s foundation. Macro research and private placement advisory have been added in the last five years.

Investment Banking: Advisory

Evercore’s Investment Banking segment includes mergers and acquisitions, restructuring, and capital markets. Most of the income comes through strategic advisory or restructuring followed by capital advisory and cash equities.

Its industry expertise is spread across 34 sectors, including media, automotive, real estate, chemicals, consumer, healthcare, and oil and gas, in 655 companies.

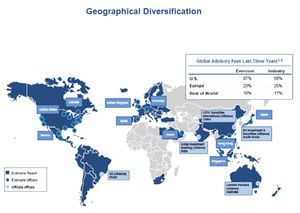

EVR generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17. EVR is widespread across 50 countries and has opportunities for revenue growth in the United States, Europe, and Asia.

Evercore generated 67% of its fees from the United States, 23% from Europe, and the remaining 10% from the rest of the world.

Investment Banking: Equities

EVR was ranked the number one independent firm in the United States by Institutional Investor in 2017. It has more analysts ranked number one than any other bank except its biggest competitor, JPMorgan Chase (JPM). It serves 1,400 institutional investors globally.

Investment management

EVR is focused on expanding its investment management in Mexico. Its assets under management have been increasing over time and contribute 20% to its operating margins. Wealth management assets have increased from $4.9 billion in 2013 to $7.3 billion in 2017.

Expected EPS (earnings per share) for EVR in 2018 is $6.77. EPS for Morgan Stanley (MS), Citigroup (C), and Bank of America (BAC) are $4.53, $6.42, and $2.51, respectively.