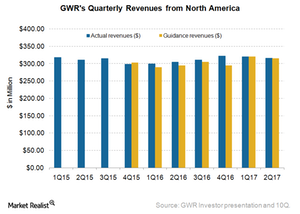

Genesee & Wyoming’s North American Revenues in 2Q17

In 2Q17, GWR’s North American revenues were $315.7 million, a 3.6% rise from $304.6 million in the same quarter last year.

Aug. 7 2017, Updated 11:05 a.m. ET

North American revenues in 2Q17

Genesee & Wyoming’s (GWR) North American revenues contribute ~60.0% of its total operating revenues. In the second quarter 2017, the North American revenues were $315.7 million, a 3.6% rise from $304.6 million in the same quarter last year.

However, those same railroad revenues in the same territory were flat on a year-over-year basis in 2Q17.

North American carloads in 2Q17

GWR’s North American carloads increased 2.8% in the second quarter 2017. The company hauled 397,000 railcars compared to 386,000 railcars in 2Q16. But note that the North American same railroad carloads fell 0.10% in 2Q17. The reported carload rise is due to the acquisition impact of the Providence and Worcester Railroad and the Heart of Georgia Railroad.

The rise in North American railcars was also attributed to higher agricultural product volumes and minerals and stone carloads. The waste and automotive carloads increased by double digits. That rise was negatively offset by lower volumes of metallic ores, pulp and paper, metals, and petroleum products.

Management outlook

Genesee & Wyoming anticipates North American revenues of $320.0 million–$325.0 million in 3Q17. For 2017, it expects its overall North American operations to contribute $1.27 billion–$1.28 billion in revenues to the overall estimated revenues of $2.1 billion. For carloads, the company projects stable levels of carloads with a marginal growth in 2017.

GWR expects flat volumes for its North American same railroad operations in 3Q17 compared to the same quarter last year. The company projects higher shipments of metals and minerals and stone compensating the volume dullness in agricultural products (ADM), petroleum products (BHGE), and pulp and paper (IP).

GWR forms part of the First Trust Industrials/Producer Durables AlphaDEX Fund (FXR), which invests 1.5% of its holdings in GWR. FXR’s overall exposure to transportation stocks, which include airlines, trucking, and railroads, is 25.0%.

In the next part, we’ll take a look at GWR’s UK and European operations in 2Q17.