Analyzing Coca-Cola’s Valuation ahead of Q3 Earnings

12-month forward PE In this article, we’ll discuss Coca-Cola’s (KO) valuation using the 12-month forward PE (price-to-earnings) ratio. As of October 17, Coca-Cola was trading at a 12-month forward PE of 21.1x. The company is trading below its YTD (year-to-date) average forward PE of 22.4x. Peers’ valuation As of October 17, nonalcoholic beverage companies PepsiCo […]

Oct. 24 2016, Updated 10:04 a.m. ET

12-month forward PE

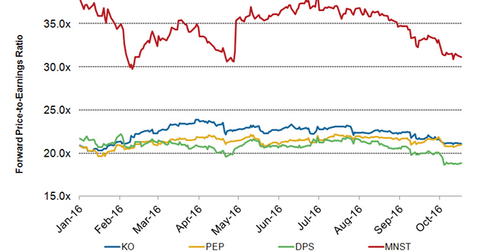

In this article, we’ll discuss Coca-Cola’s (KO) valuation using the 12-month forward PE (price-to-earnings) ratio. As of October 17, Coca-Cola was trading at a 12-month forward PE of 21.1x. The company is trading below its YTD (year-to-date) average forward PE of 22.4x.

Peers’ valuation

As of October 17, nonalcoholic beverage companies PepsiCo (PEP), Dr Pepper Snapple (DPS), and Monster Beverage (MNST) were trading at 12-month forward PEs of 20.9x, 18.9x, and 31.2x, respectively. The premium valuation of Monster Beverage compared to Coca-Cola and other major nonalcoholic beverage peers is due to its higher sales and growth expectations.

Coca-Cola purchased a 16.7% stake in Monster Beverage in June 2015 to capture growing opportunities in the energy drink market. As part of a strategic deal with Monster Beverage, Coca-Cola transferred its energy drink portfolio to Monster Beverage in exchange for the latter’s non-energy drink brands.

Coca-Cola and Monster Beverage together constitute 5.4% of the iShares Global Consumer Staples ETF (KXI).

Fiscal 2016 expectations

Currently, analysts expect Coca-Cola’s 2016 revenue to fall 5.9% to $41.7 billion. Analysts foresee Coca-Cola’s adjusted EPS (earnings per share) falling 4.5% to $1.91 in 2016. Coca-Cola’s performance is expected to be impacted by forex headwinds and weak soda volumes.

Analysts expect the 2016 adjusted EPS of PepsiCo, Dr Pepper Snapple, and Monster Beverage to grow 4.8%, 8.7%, and 30.4%, respectively.

We’ll discuss analyst recommendations for Coca-Cola in the concluding part of this series.