Factors that Drove the British Pound over 1.38 against the Dollar

During the week ended January 29, 2018, British equity markets (BWX) were supported by the prospect of a soft Brexit.

Jan. 22 2018, Updated 3:50 p.m. ET

British pound trends higher

The British pound (FXB) posted its fifth consecutive weekly gain against the US dollar. For the week ended January 19, the British pound (GBB) closed against the US dollar (UUP) at 1.3852, appreciating by 0.90%.

The political developments that helped British Prime Minister Teresa May receive the votes required to approve a key Brexit bill also added to the upward pressure on the pound. However, economic data disappointed as British retail sales missed expectations and consumer prices slowed.

British equity markets (BWX) were supported by the prospect of a soft Brexit. The FTSE 100 Index (EWU) closed at 7,730.79 during the week ended January 19, depreciating by 0.62% for its first weekly decline in seven weeks.

Speculators turned bullish on the British pound

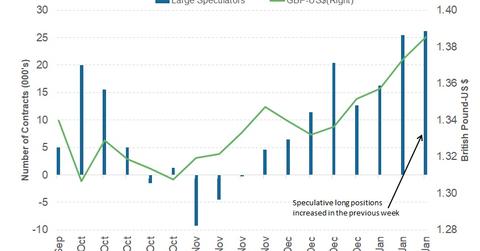

According to the latest Commitment of Traders report, released on January 19 by the Chicago Futures Trading Commission, speculators increased their bullish positions on the British pound in the previous week.

The total outstanding net positions increased from 25,492 contracts to 26,204 contracts for the week ended January 19. The rise in long bets was fueled by the increasing probability of a soft Brexit. Unless there is a negative economic data surprise, we can expect further positioning for a stronger pound.

Outlook for the British pound

For the upcoming week, we can expect economic data from the UK that includes employment numbers and the 4Q17 GDP report. With the recent disappointing economic data, we can expect a dull GDP report and limited gains in the British pound. If the US dollar’s weakness persists, dollar sales could increase and indirectly support the pound in the week ahead.

In the final part of this series, we’ll analyze whether the Bank of Japan might follow the Federal Reserve and the ECB to announce its intention to tighten policy.