Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 1)

Market Realist analysts recently conducted a Q&A with experts from VanEck on the generic pharmaceutical industry, a space that has attracted investor interest due to upside potential from brand name drugs coming off patent, cost saving pressure in the healthcare industry, and increased worldwide demand for prescription drugs (for more on these topics, please see […]

Sep. 1 2020, Updated 10:00 a.m. ET

Market Realist analysts recently conducted a Q&A with experts from VanEck on the generic pharmaceutical industry, a space that has attracted investor interest due to upside potential from brand name drugs coming off patent, cost saving pressure in the healthcare industry, and increased worldwide demand for prescription drugs (for more on these topics, please see Rx for Growth: Why Generic Drugs Are Gaining Traction, Generics Keep Lowering Healthcare Costs: Opportunity Ahead?, Drug Patent Expirations: $190 Billion in Sales Up for Grabs, and Biosimilars: Why You Can Expect Opportunity Ahead).

Read on to find out essential information about the space, including how to value generic pharma companies, and crucial indicators investors should monitor.

1. Which companies are the biggest players in the generic space? What do you see as the major catalysts for these names (ex: specific drugs coming off patent, increased competition for marquee drugs, pricing pressure for certain drugs)?

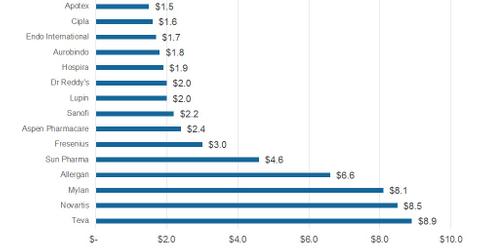

Teva Pharmaceutical Industries, Allergan, and Sun Pharmaceutical Industries[1. Teva Pharmaceutical Industries, Allergan, and Sun Pharmaceutical Industries accounted for 8.46%, 8.40%, and 6.49% of the VanEck Vectors® Generic Drugs ETF, respectively as of 2/29/2016.] are three of the largest companies worldwide that generate a significant portion of their revenues from generic drugs. Along with other names in the sector, these three companies may stand to benefit from the ongoing push to lower global health care costs. Governments are currently the primary consumers of health care services and generic drugs typically offer a less expensive alternative to branded drugs and may offset rising costs.

The above chart shows revenue for leading generic pharma (GNRX) companies including Teva (TEVA), Sanofi (SNY), Fresenius (FNS), and Dr. Reddy’s (RDY).

2. What metrics does the industry usually value generic pharma companies by? (ex: PE, EV / EBITDA, dividend yield, etc.)

P/E (price-earnings) ratios[2. The price-earnings ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.] are important when evaluating the generic pharmaceutical sector, but there are other intangibles one should consider. Drug pipelines and progress toward FDA approval are also key. These factors may in fact account for higher P/E ratios as drugs in a company’s pipeline have yet to impact earnings.

3. How would generics fit into a portfolio with biotech and pharmaceuticals?

Investors seeking exposure to pharma and biotech should consider including generics in order to help round out their portfolios. It can be easy to overlook generics when constructing a pharma and biotech portfolio because headlines often highlight blockbuster drug approvals and significant medical advances. In many regions of the world, however, the majority of prescriptions are filled with generic drugs and many experts expect considerable future growth in the generics market.